Why IT Firms Are Investing in GCC Advisory Firms

- Mphasis invested $4 million for a 26% stake in Aokah, a US-based GCC advisory firm, in July 2025. CEO Nitin Rakesh explained that the move allows Mphasis to shape client deals early as they design their GCC strategy.

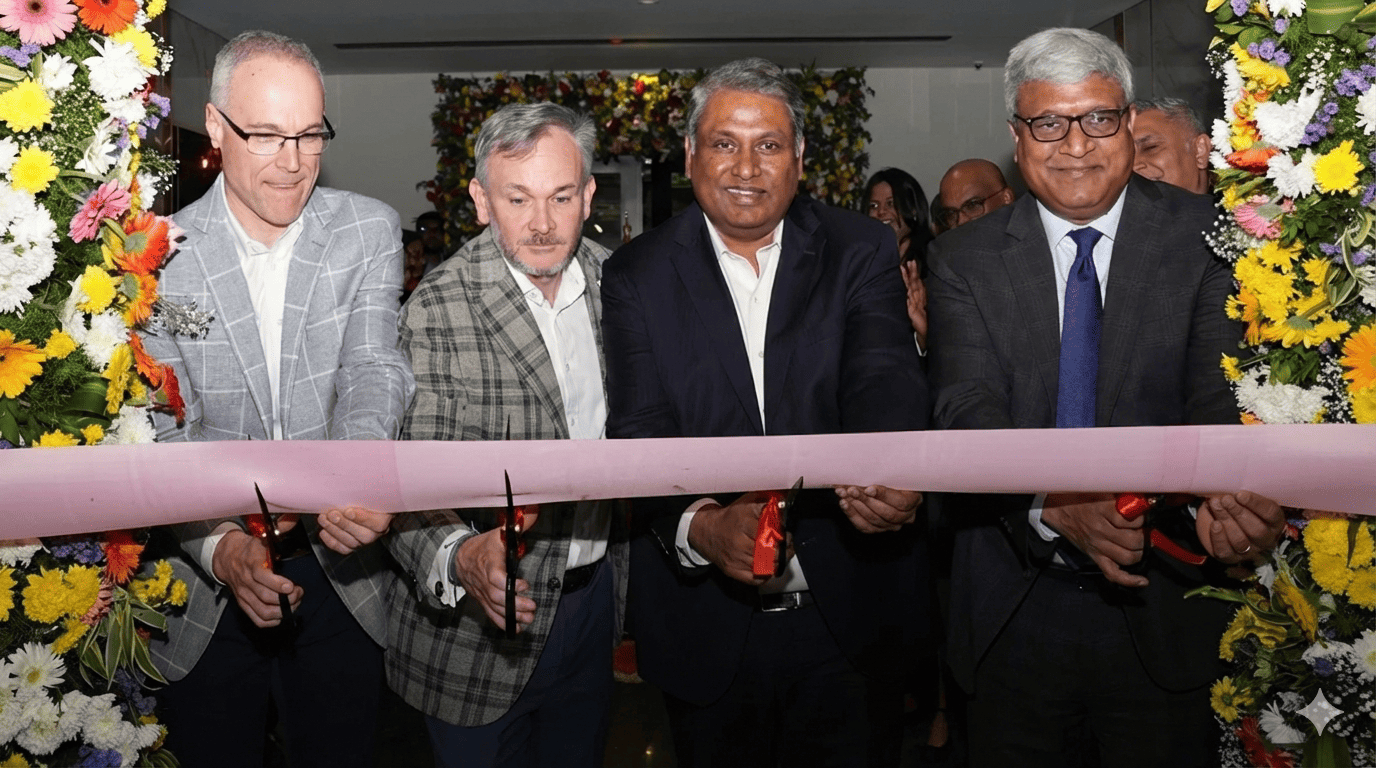

- Hexaware acquired SMC Squared for $120 million the same month. CEO Ramakarthikeyan Srikrishna highlighted the firm’s ability to set up GCCs but pointed out that Hexaware would bring transformation capabilities, particularly in AI-driven operations.

GCCs: Opportunity and Challenge for IT Outsourcers

While GCCs provide IT firms with new opportunities, they also bring competition. Many large corporations are increasingly hiring engineers directly into their in-house tech hubs, impacting the outsourcing pipeline.

Persistent Systems CEO Sandeep Kalra noted a slight uptick in attrition across the industry as engineers shifted from IT service providers to in-house GCCs set up by banks, product companies, and global enterprises. Persistent itself posted $389.7 million in Q1 revenue, up 3.9% sequentially.

Traditional models such as the Build-Operate-Transfer (BOT) approach have faced challenges, particularly around client trust during the transfer phase. By contrast, investing in nimble GCC advisory firms allows IT outsourcers to sidestep trust issues and gain quick wins.

Analysts Weigh In

- Phil Fersht, CEO of HFS Research: “Mid-cap IT firms aren’t avoiding GCCs; they’re cutting to the front of the line. By investing in specialist advisory shops, they buy instant expertise.”

- Thomas Reuner, principal analyst at PAC: “Just like AI, GCCs are a topic that cannot be avoided when discussing the future of IT services. Moves by Hexaware and Mphasis show that demand is shifting rapidly.”

Broader GCC Market Trends

India currently hosts over 1,760 GCCs, a number expected to hit 2,200 by March 2030 (Nasscom). Smaller GCC advisory firms such as Gloplax Solutions, Stratinfinity, and Bridgepath Innovations are also emerging, helping global enterprises navigate compliance, infrastructure, and hiring in India.

The trend is not limited to mid-cap players. Accenture acquired a minority stake in ANSR, India’s largest GCC advisory firm, for $170 million in July 2024, underscoring how even global giants are betting on the GCC consulting model.

Conclusion:

The GCC wave is reshaping India’s IT services landscape. For mid-sized IT firms like Mphasis and Hexaware, investing in GCC advisory companies is a strategic shortcut to gain client trust, secure long-term contracts, and stay relevant in a market where capability, not cost, defines competitiveness.

Read more full news: Here